Form 1040 Schedule Se 2024 Tax Form – Tax season has started for 2024. Find out when you need to file your taxes with the IRS and your state, and when you can expect your refund. . The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024 well as deductions for self-employment tax, student .

Form 1040 Schedule Se 2024 Tax Form

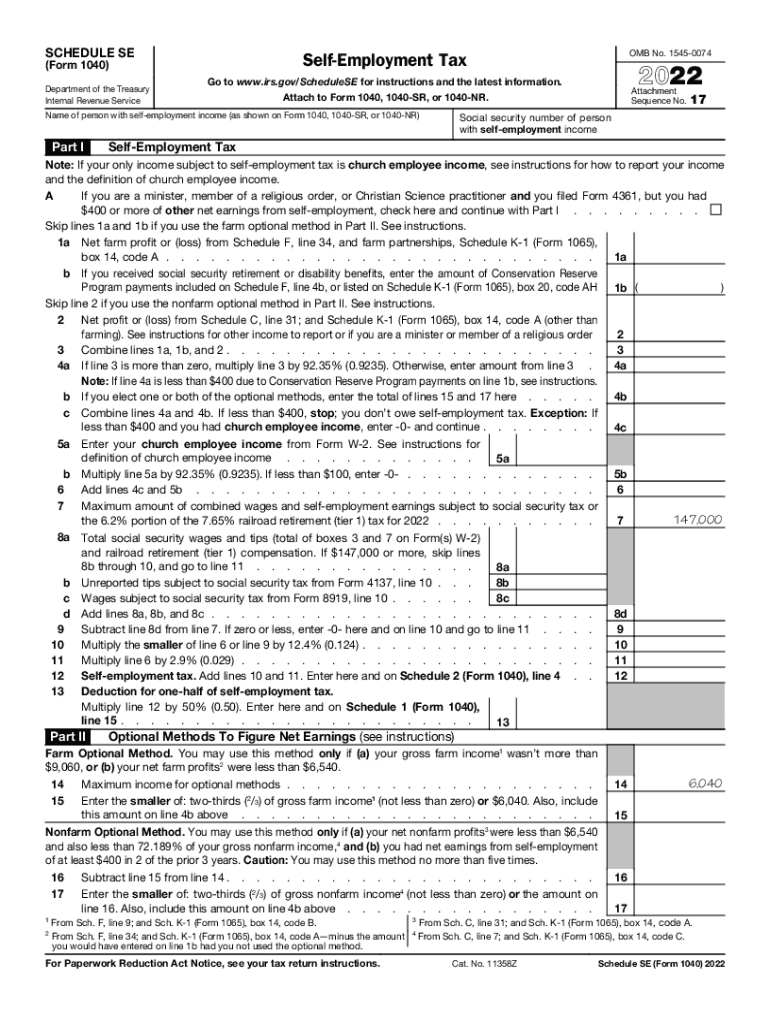

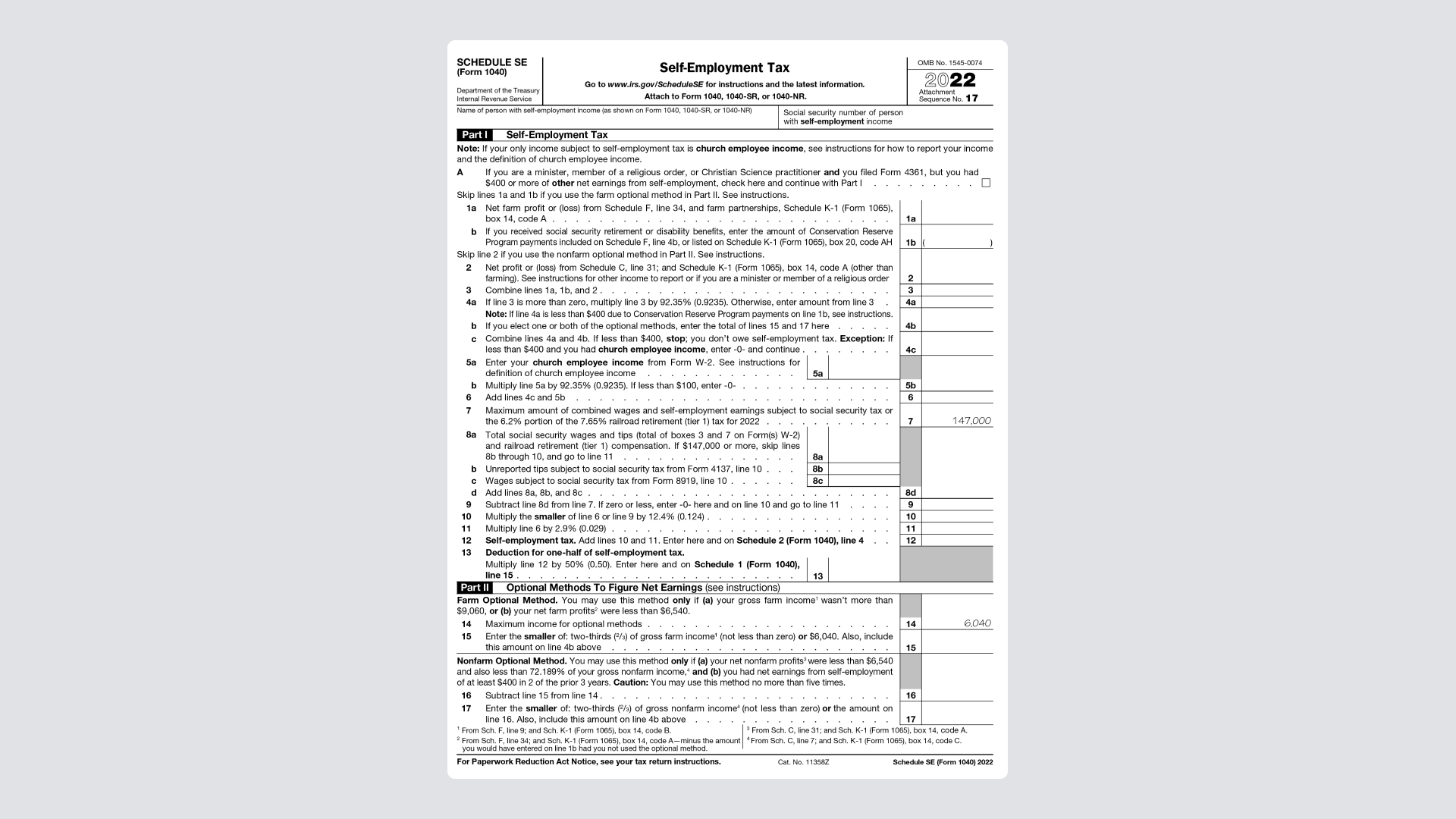

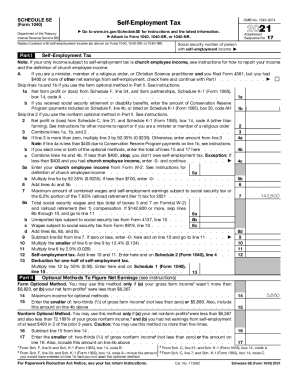

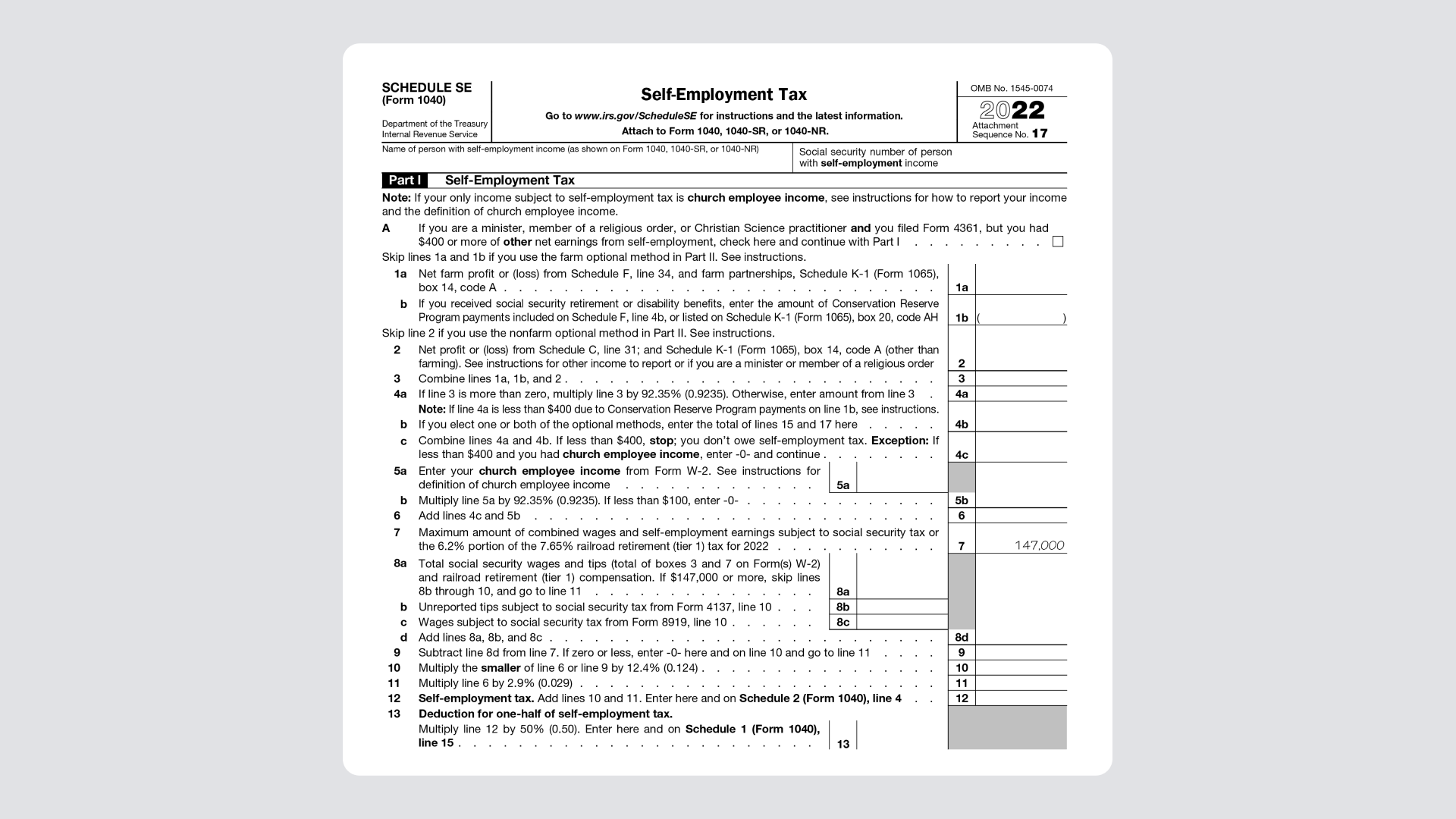

Source : found.comIRS Schedule SE (1040 form) | pdfFiller

Source : www.pdffiller.com1040 (2023) | Internal Revenue Service

Source : www.irs.govA Step by Step Guide to the Schedule SE Tax Form

Source : found.comForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.com2023 1040 schedule se: Fill out & sign online | DocHub

Source : www.dochub.comSE1204 Form 1040 Schedule SE Self Employment Tax (Page 1 & 2

Source : www.greatland.comSelf employed taxes 2022: Fill out & sign online | DocHub

Source : www.dochub.comSE1204 Form 1040 Schedule SE Self Employment Tax (Page 1 & 2

Source : www.nelcosolutions.com2023 Form IRS Instruction 1040 Schedule SE Fill Online

Source : tax-form-1040-instructions.pdffiller.comForm 1040 Schedule Se 2024 Tax Form A Step by Step Guide to the Schedule SE Tax Form: Report this using Schedule SE. The self-employed must prepay their estimated taxes quarterly, using Form 1040-ES vouchers. State and Local Tax Forms Each state and local governmental entity has . Look for it on Schedule 1, Line 19, and attach it to Form 1040 This tax break can be claimed on Schedule 1, Line 21. And it doesn’t matter who the loan was for. Self-employment taxes might .

]]>

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)